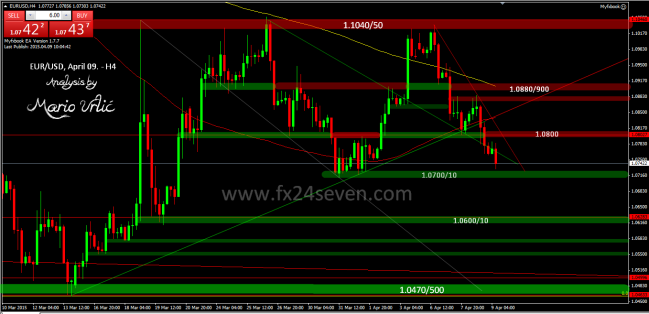

EUR/USD, searching for the buyers!

Even the pair has rejected from the trendline up from 1.0800, it didn’t manage to pass true 1.0886 yestreday, after wich has just slided down true the support. For now, EUR/USD reached the low of 1.0730 and that is the buyers teritory all the way to 1.0700, which is previous strong support from March 31./April 01. Could that level hold the decline? The pair is looking bearish today and this is 4-th day in a row in red for now. US dollar showing his strenght in the market, again! It want be easy for the euro bulls, if there is any!?

Well yet again I got the movements wrong. For a start there was a really nasty bounce which tested the highs of the London open. From there a gradual decline developed which intensified as the New York session got underway. It cut through the support level at 1.0700/10 like a knife through butter without even so much as a pause. There was a bit of respect shown for the S2 pivot though not a lot – well it bounced long and retested it. My daily ATR level at 1.06583 quite a lot of respect as it held for nearly an hour and a half. The rout continued till after lunch in New York and the market has entered a period of consolidation. The total daily range for today has been 151.1 pips which is significantly greater than the daily ATR (14 periods). As I look at the charts, the daily ATR level at 1.06583 is showing itself to be resistance which is only to be expected – previous support turned resistance.

As for me, the bounced really hacked me off and I made the positive trading decision to take my children out for a walk in the glorious sunshine and let the markets take care of themselves. It was the absolute right decision and the walk in the Chilterns was really lovely and even the children enjoyed it – so it must have been good. And when I got home the markets had served me up a real treat with all positions being substantially up. On a more responsible note, I did not actually leave until the price action had broken once again below the Asian low. There was a falling three methods candle pattern which is continuation pattern. From there on it was a rout.

In summary it was a great afternoon. I have made my weekly targets and tomorrow is the last day of the school holidays (weekend excluded). I plan to take the day off and take my children out for a special day at one of their favourite attractions namely Mead Open Farm. It is far too common on a Friday to lose every last pip and more made during the week. If I do not trade, that cannot happen.

LikeLike

This is a difficult one. There are good arguments to go long down at the support in the area 1.0700/10. However the rising trend line failed to hold the price action – to my cost.

I am currently short and looking to close out in the 1.0700/10 area. As Mario has pointed out, it is a support area. However there are other arguments for closing in this area. The first is that the weekly ATR (14 period) is 332.4 and assuming that the weekly high is 1.10355, the weekly range low would be 1.0703. The 15 minute chart shows a very decent downtrend and currently a descending triangle which I hope will lead to a break lower and towards my target just above 1.0700.

My over all current trade plan is to take profit just above 1.0700 and look to renter on a 382 fib level retracement adding up to the 50% fib level. The stop will be a break above the 618 fib level. At present the 1.0730 area is providing strong support having resisted two tests. However this second bounce is not as high which might be an indication that the bulls are weakening and will be prepared to concede the level. The next level for them to defend will be the 1.0700. It is likely that there will be options around this level and the fight could be quite dramatic as the option players join the affray.

Clearly if the 1.0700/10 area gives way, it is all roads south with nothing till 1.06368 and that might only just be a pit stop. It is Friday tomorrow when there will almost certainly be reduced liquidity. With potential a June rate hike for the Dollar and if not a probable one in July, the Euro is not attractive. The only thing currently in its favour is that the medicine seems to be starting to work and there are definite green shoots. There is of course the on-going problem with Greece who now seems to be talking to Russia.

LikeLiked by 1 person