A total mess on Oil market with CFD’s, Futures, rollover’s and some more…

If you are an amateur retail trader you’ve probably don’t know what in the hell is happening with Oil prices recently (I am not talking about the fall) and that’s not strange. We experienced traders are also confused, searching for the proper explanations. To be honest, I found a couple of good ones, but I can honestly say that I don’t understend them well enoughfor now, but exploring to find out everything. It’s a total mess to most of us.

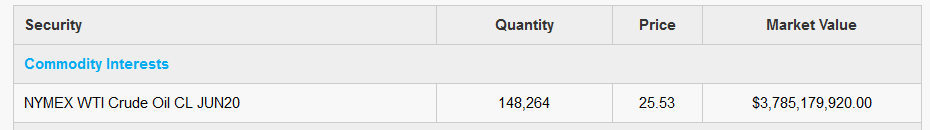

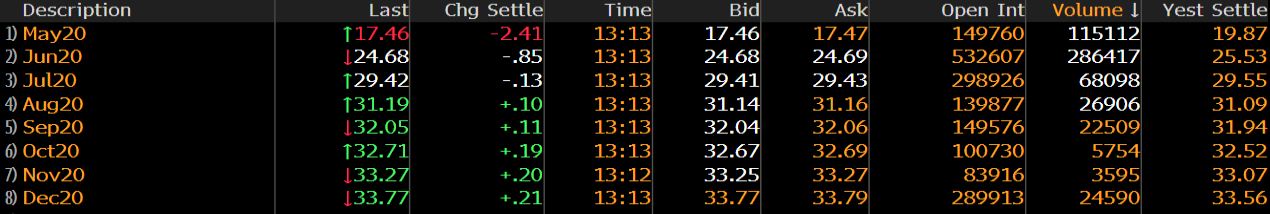

The price which you’ve followed last week is probably 30% different in this week because of the rollover (new June contracts) and that rollover was the biggest one since I follow the Crude oil, with huge price difference as you can see in your platforms. In my platform (VantageFX) Crude Oil rollover price has been changed on Thursday/Friday, from $19.68 to $26.47 which totaly disrupt a posibility for proper techinical analysis. I mean, this is a totaly legit price change (rollover), but it changes everything so far.

An earlier rollover at my broker and I think how they made a good decision if Oil continue with sharp fall

At first, here’s an explanation of such a huge Rollover from my broker;

Due to the current uncertainty about future demand resulting from COVID-19 as well as supply due to potential future intervention by OPEC+ (and potential resolution of their current conflict) we are seeing back month contracts trade at much higher spreads than normal in the market.

As a result the overnight swap fees in cash products have become much higher particularly as they approached the rollover date of the front month expiring contract.

What is a cash product?

A cash product is an over-the-counter derivative product of the futures contract. USOUSD is such an example, which is a derivative of Oil futures product. Unlike Futures products, the Cash products trade continuously with no expiration date.

What is a swap fee and how is it calculated for the cash products?

When clients hold a cash product past end of the trading day, similar to currencies and metals, the product attracts swap fees. This is shown under the ‘Swap’ column on your trading account statement. The swap fee can be calculated as below:

Swap rate x Volume x Contract Size x Number of Nights

What does the swap fee consist of?

The swap fees for the cash products consist of the following two important components:

- Overnight financing charges covering the borrowed money required to open your position, outside the initial margin you’ve paid, and

- A fair value price adjustment, an adjustment made to the product’s pricing based on the fair market value of the underlying security.

Why do the CL-OIL (futures contract) and USOUSD (Cash product) have such a large price difference currently?

Due to the uncertainty about future demand for oil because of the slowdown of growth across the world resulting from COVID-19, we are seeing CL OIL future contracts trade at higher prices than the USOUSD cash price than ever before.

As a result, the overnight swap fees in cash products have become much higher as compared to past weeks.

What are the main factors for the significant difference in prices across the two products?

The main factors contributing to the vast differences are as below:

- Between May and June WTI oil futures contracts, there is currently a price difference of approximately $6.30. When CL-OIL futures rolled over from May to June contracts on 17th of April, the price gapped up by the same magnitude.

- USOUSD or the cash WTI oil product is priced differently. In order to minimize price disruption and remove the impact of large price differences between the contract months, the USOUSD’s price ‘spreads out’ the price difference over the course of the next 28 days, until the next futures contract expiration…

Please consider the implications carefully and trade cautiously during this volatile period.

Furder on. Based on the article from Justin Low forexlive.com, front month WTI crude oil extends fall to nearly 30%, closes in on $13.

forexlive.com

forexlive.com

Thank you Mario. I didn’t understand 30% but at least I realize that I am not alone in that situation with my broker (I have to pay a huge swap). 😦

LikeLike