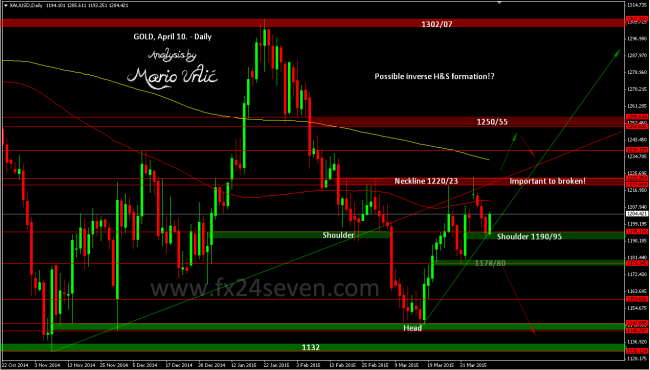

GOLD, possible inverse H&S!?

This is potential inverse H&S there is no doubt, but 1220/23 is the main target to be broken for furder development here. We could see that the ‘second shoulder’ at 1190/95 is holding for now, despite strong US dollar in the market and that is important level as well on the way down. If gold manage to stay between 1190/95 and 1220/23, this development is possible. Watch this levels and furder development, I will cover every move furder. I was allready wrote about this possible formation in my previous gold analysis. Interesting view, isn’t it!?

Personally I don’t trade gold myself, though I do keep a weather eye on its movements for correlations with other currencies. I am a perpetual gold bear seeing no use for the yellow stuff other than draped around the neck of expensive women – I guess that I am a bit of a Philistine at heart. This bearish approach makes me unpopular with other retail traders and also my friends from the Indian Subcontinent who love the stuff.

The thing is that if you are right and you put forward a very sound and convincing argument, what does it mean for the currency pairs and in particular EUR/USD. The fist thing is that strong gold prices mean a risk off environment. Also strong gold prices means a lowering in expectations of a rate hike any time soon. This is across the board and particularly so for the Dollar. Whilst the market is pricing in a potential June rate hike for the Dollar it is by no means certain. The latest NFP figures were disappointing and it maybe that further data disappoints. Should this occur a June rate hike will be off the table and could be delayed till next year. In such circumstances gold will rocket higher completing the inverse head and shoulders as people will hold gold which pays no interest yet is secure against the Dollar which too pays no interest and whose security is undermined by the use of the FED’s printing presses.

At heart I am a Euro bull though of late even the strongest of us have been taking short positions. It maybe that the current range for the EUR/USD for the rest of the year is between 1.0500 and 1.10000. Whilst there is lots of talk about an interest rate hike, it has not happened and will not happen until it happens. At this stage I would quite like to see the colour of their money rather than continue to listen to their talk.

The other thing is that the Euro is becoming a safe haven currency and I think will be replacing the Yen very soon. One of the reasons for saying this is that things in the Eurozone cannot get any worse – it is a ‘Perfect Storm’. Also the Euro is fast becoming the funding currency of choice. Thus like with the Yen as soon as their is a risk off environment, the Euro will strengthen.

This sort of scenario would be supportive of my suggestion that the range for the Euro for the rest of the year will be between 1.0500 and 1.1000.

Having said that if the price action starts seriously breaking below 1.0500, I shall be the first to be pressing the short button. I don’t mind picking a double bottom at 1.0500 but I am not up for picking any bottoms below that level.

Interestingly this weeks COT has shown a small yet significant reduction in Euro short positions and maybe this is the start of short positions being being covered.

LikeLike

This is courage, way to go my friend.

LikeLiked by 2 people

You’re the man. 🙂 Let’s see this, fantastic.

LikeLiked by 2 people

Very interesting view Mario, thanks for sharing this with us, amaizing.

LikeLiked by 2 people