EUR/USD, steady despite all the bad news!

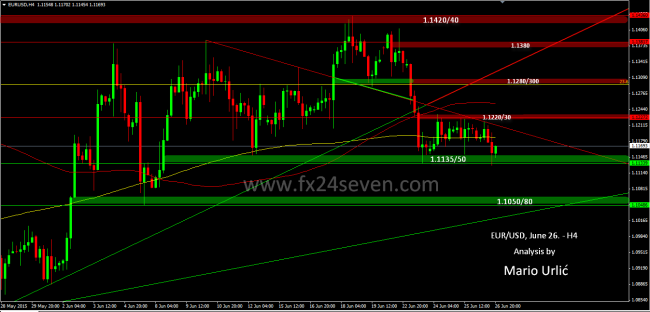

And, that is the reason why I always talk about technical levels. There was so many news about Greek deal in the last three days, mostly bad ones and what happen with the euro at the end? Nothing! In my last article on the Greek crisis, which I wrote on June 22., I wrote that I will ignore all the up coming news and not to write about it, until the end. And I was right! EUR/USD was choopy in the last couple of days, but you can take a look at my previous analysis and see, that all moves was between small range from 1.1135/50 and 1.1220/30. In between there was several smaller levels wich were the turning points during the day in the range of 30/40 pips roller coaster ride, supported with smaller trend lines, support/resistance levels and MA’s on the most time frames. The pair ended the week at 1.1170, above the strong support at 1.11350/50 which was hold the strongest bears during the last day of the week. I wrote in my previous analaysis, that the buyers are serious and ready at the lower levels for this week, same as the sellers up to 1.1220/30. Let’s see how the pair will open the next week, that will depend on the possible Greek deal or no deal, that’s for sure. If there can be any deal at all!?

This, as always, is a very interesting perspective. There has been non-stop chop which is great for the range traders who sell at the highs and buy at the lows. However it has not been so good for the trend traders which include breakout traders who will tend to open a position upon a break of the high or low. The first question is what is going on fundamentally. The EUR/USD is lodged within the January range while the fires rage in Greece. With what is going on, a fundamental analyst would surely say that the EUR/USD should be ranging around parity and not 1,250 pips above. I think what might be going on is the market seeking the safety of German bonds which is keeping the Euro elevated. Whist it must be accepted that German data has been just a bit soft of late, nevertheless it has generally been very robust and often beating market expectations.

Thus I do no longer think that the market has the slightest interest in the affair of Greece. After all it represents only a tiny fraction of the whole Eurozone economy. This would help explain the elevated pricing of EUR/USD. If a Greek deal is secured then possibly there will be a small rally maybe of no more than 50 pips. However if a Greek deal is not secured, the whole thing becomes very much more interesting. The question that will be entering the debate is whether the Eurozone is just a series of pegged currencies or genuine monetary union. If no deal is reached, I do not see any alternative other than Greece leaving the Eurozone. If Greece leaves does that set a precedent for other countries to leave. At present there is no framework for Greece the Eurozone and it is questionable whether departure from the Eurozone would also mean departure for the European Union. Until the Lisbon Treaty there was no mechanism for a member state to leave the European Union and the Treaty introduced a method which maybe will be tested by the United Kingdom of Great Britain and Northern Ireland. Since the UK is made up of four separate realms does there have to be a majority in all four realms to leave as suggested by the leader of the Scottish National Party? Nothing with the European Union is simple -if only it was.

Thus I do think we will be seeing a return of the rhetoric suggesting an imminent break up of the Eurozone and maybe the European Union itself. This will see a plunge similar to one one seen two years ago leading up to Mario’s immortal words : to do anything that it takes.

I see little chance of any Greek deal and this will be the precipitating factor and not the cause of a fairly sharp fall to EUR/USD parity and below next year. A deal will merely delay matters and the decline could be precipitated by Portugal when it enters crisis. Nevertheless I don’t think the market will be kept waiting that long.

The only way to avoid this occurrence is for there to be full monetary union. That will mean surrendering further very substantial sovereignty to Brussels and there may not be sufficient level of political determination yet. It will come and maybe the unfolding crisis might expedite it very quickly. As soon as I see this happening, I shall once again become a proud Euro bull. Meanwhile I am a turncoat bear.

LikeLiked by 1 person

I agree and that is why I didn’t pay much attention at this Greek saga in my analysis this week. On the other side, the news was strong movers and the opportunitie for the buyers/sellers, as You say the range traders. This situation in the market doesn’t suit me and my way of trading, because my targets are way above the 50 or 70 pips range. It doesn’t matter that I have a great analysis and fantastic levels, it’s make me nervous during this choopy up/downs.

If we take a look at Greece saga, I also don’t see the easy solution for this deal. But, what can they do without EU? On my oppinion they would need 50 years of recovery without EU. On the other hand, with debt like this and with no serious reforms, they will never get out of the troubles. It’s not easy decision and it could take months for the serious and suitable solution for both sides.

LikeLike

I agree that Greece might find it tough outie the Eurozone, though possibly even tougher within. The Greek economy is like a Trabant among the highly tuned Formula One cars of the German and French economy. With the Eurozone, one size fits all and that size tends to suit the German and French economy rather than the struggling Greek economy. Next to join that league is likely to be Portugal. However Ireland has done very well remaining within the Eurozone and is returning to health. It would be nice to think that Greece could follow the example set by Ireland though I don’t see it myself. I do think that Greece would be better served by Grexit with the Drachma undergoing a period of massive devaluation. Only that way will the imbalances created by membership of the Eurozone be readjusted to more appropriate levels. Possibly the reason for Ireland’s success is that it never faced such imbalances and in reality it crisis was relatively short lived as opposed to the Greek problems which will soon have been running for ten years.

LikeLiked by 1 person