I told you that I will smash the euro…

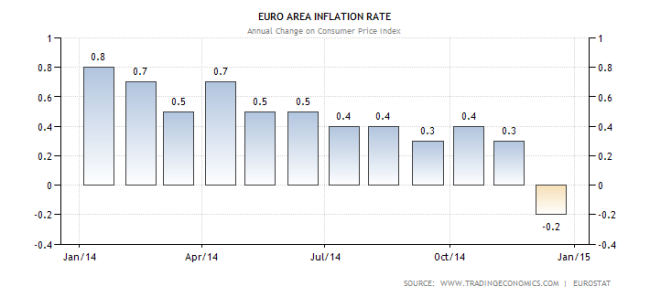

…if Euro area inflation aproach to 0%! In December 2014. inflation fell bellow zero, to -0,2% and in this week, Mr.Mario Draghi (ECB) ‘fire up’ the 1.1 trillion euros QE in total, ie. to buy 60 billion in sovereign bonds each month until at least September 2016 . They decided to do everything in order to boost Euro area recovery, with the main objective of weakening the euro.

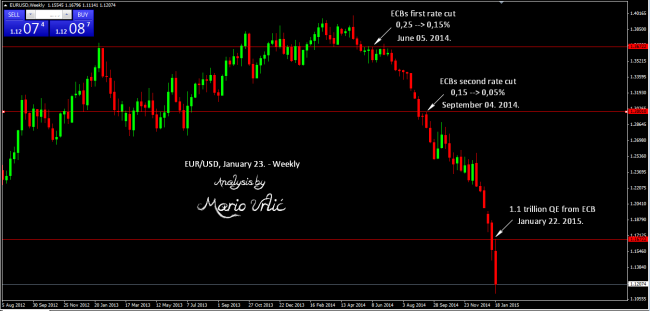

The ECB aims at inflation rates of below, but close to 2% over the medium term. In 2014., the ECB cut rates two times. First time in June 05. from 0,25% to 0,15%, when inflation rate was 0,5%, and second time surprisingly in September 04., from 0,15% to 0,05% when inflation rate was 0,3%. Probably, they were convinced that inflation will continue to fall until end of the year and they were right. Euro area inflation in December fell to -0,2%., after wich they louched a new QE messures with 1.1 trillion euros at this Thursday.

How about EUR/USD? You can see that the pair was at the 1.3670 level during the first ECBs action, after wich the pair start to slide a few weeks latter, and until second ECBs move, the pair manage to get to the 1.3000 level. Second move was surprise for the market and the pair start to fall immediately, but the fall stoped at 1.2500 and recover for a while, after wich the fall continued furder and until end of the year, the pair catch 1.2100 and close the 2014. at the same level. In 2015. the pair didn’t stop to fall, and it was waiting for yesterdeys decision at 1.1650. After the yesterday ECBs 1.1 trillion QE decision, EUR/USD fell more then 500 pips, and catch new 12 years low, 1.1114! At the end, we can see that the measures of the European Central Bank had a strong impact on the weakening of the euro, in total of -26% verus US dollar. But, is this the end of the euro free fall? Not yet in my point of view!? While the ECB is lounching QE’s one after the other, we are waiting for FED to start with tightening monetary policy until end of the year. It will be an interesting year.